Level up with courses that work for you

We offer accounting and financial education to meet your personal wants and needs. With exam prep, professional development and skill building courses, you will advance with confidence.

Exam Review

Our Exam Review courses use leading technology to personalize your study experience. You will get to exam day faster and be well-prepared to pass and launch your career.

Continuing Education

Maintain special licenses and certifications with our broad selection of topics. We offer timely, engaging content to help you remain at the cutting edge of accounting and finance.

Skill Building Certifications

Looking to take the next step in your career? Access our extensive catalog to choose from available certifications. We address current topics and teach the industry’s most in-demand skills.

FEATURES

Here’s what sets us apart

For over 35 years, Surgent has been a trusted partner in helping accounting and finance professionals launch and lead successful careers. We have proudly served over 250,000 professionals, providing top-rated exam reviews, continuing education and skill-building courses.

No two students are alike – Your course of study should be as unique as you are!

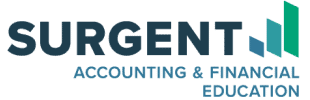

Our A.S.A.P.® Technology measures student strengths and weaknesses, helping to formulate a student-centered study plan. The result? Our students are exam-ready up to 4x faster than those enrolled in other exam review courses.

We’re so confident you’ll pass, we guarantee it.

Pass the first time taking your exam, or you get your money back! Our exam review materials empower students with all the information they need to be prepared and confident on exam day. Guaranteed.

Our technical team creates a seamless learning experience. Our industry experts craft courses with the most up-to-date content to ensure candidate success. Our highly qualified instructors guide you through the coursework.

“I have used Surgent as far back as I can remember…

For the record, I receive many solicitations from other CPE webinar producers, at a much lower cost. I have used Surgent as far back as I can remember, always looking for their live seminars prior to the technology of webinars in the convenience of the office. Your webinars are always informative and accurate, and the speakers reflect their knowledge of the subject. Keep up the good work.”

Steve Herman, CPA

Built to meet your needs

Individuals

Students use customized prep courses for all major accounting and credentialing exams.

Firms and Corporations

Business partnerships enable learning and development for staff members at each stage of their careers.

Faculty

Over 300 colleges and universities integrate exam prep coursework into their accounting and business programs.

Switchers

When other courses fail to deliver, turn to us. We offer a discounted rate on exam reviews to those who switch.

Students

We will help you start your careers. In addition, we offer discounts for students who are currently in school.

Associations

We partner with a range of national and state societies to offer additional support to our members.

Looking for a partner in education?

SURGENT IQ

Introducing Surgent IQ

Our catalog of certification courses is designed to offer digital, hands-on learning experiences to students and professionals looking to take their careers to the next level.

How Surgent IQ is changing the game

Accounting and finance professionals can stay up-to-date on industry trends and in-demand skills by utilizing our Surgent IQ products.

Interactive learning experiences

We offer high-quality digital courses taught by engaging industry experts. Our courses give students the information they need to fully grasp concepts for deeper understanding.

Work around your schedule

We understand being a student or professional comes with unique time commitments and responsibilities, so we offer digital courses that give you the freedom to learn on your time.

Stay on the cutting edge

Accounting and finance professionals can stay abreast of the most in-demand skills in their industries, giving them an edge within their fields.

Looking to move into a new role, and need some help developing the necessary skills? With SurgentIQ, you’ll have access to courses designed to help you become your professional best.