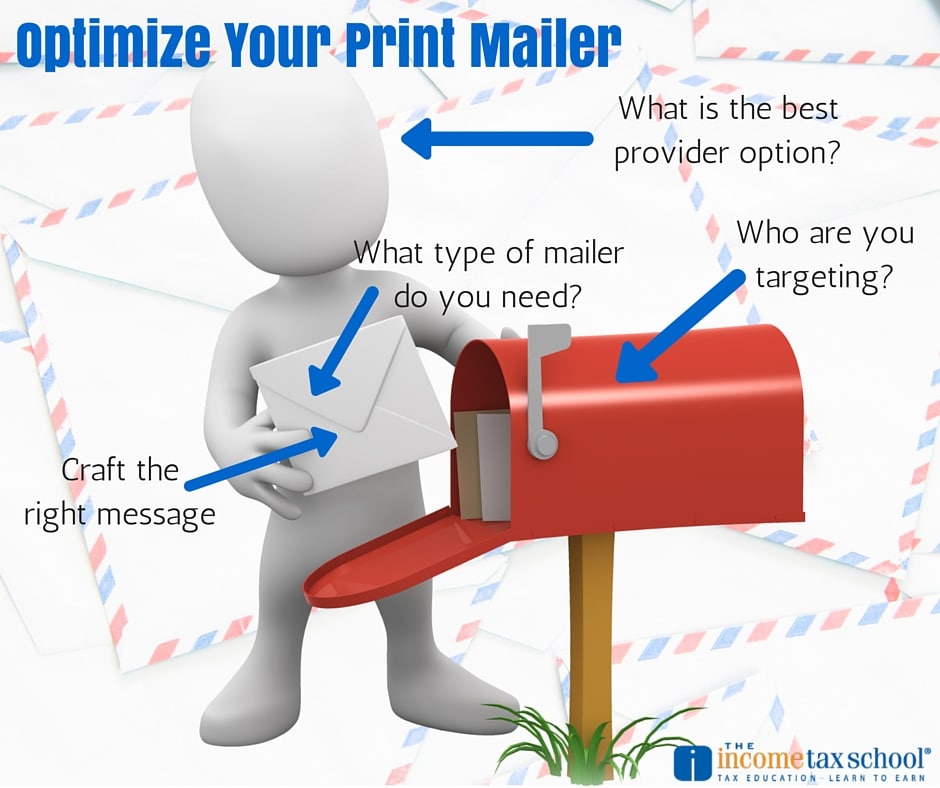

Thanks to email and the Internet, tax businesses in general do a lot less print mail than they used to. Even so, print mail is making a bit of a comeback and many tax firms still use it to drive business during tax season. People get so many emails these days and many go straight to junk […]

Displaying: January 2016

Transitioning to new Revenue Recognition Standards

In a recent poll, many companies said they have not yet attempted to quantify the financial statement impact of the new revenue recognition standard.

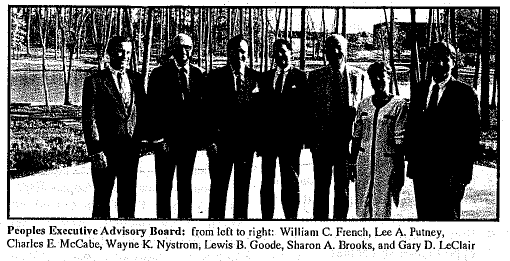

Grow Your Company With An Advisory Board

“No man is an island; entire of himself…” This famous line written in 1624 by English poet John Donne is still sage advice for anyone, especially an entrepreneur. If you’re satisfied being an independent contractor compensated directly in proportion to your personal services rendered, you won’t need a board. But if you want to build […]

Don’t Miss This Crucial Step In Gaining Your Record Of Completion

If you’re currently trying to gain your IRS Record of Completion, the IRS wants to make sure you don’t miss a step. Have you completed the requirements of the AFTR program? Did you completed the required continuing education by Dec. 31, 2015? Have you renewed your PTIN? How about signed the Circular 2030 consent? According to a […]

New Lease Accounting Standard IFRS 16 testable on CPA Exam October 2019

On January 13, 2016, the International Accounting Standards Board (IASB) issued International Financial Reporting Standard (IFRS) 16, Leases. This will be testable on the CPA Exam beginning in October 2019.

FASB releases ASU 2016-01, Financial Instruments – Overall

The FASB issued Accounting Standards Update (ASU) 2016-01, Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, affecting public and private companies, not-for-profit organizations, and employee benefit plans that hold financial assets or owe financial liabilities. The ASU will take effect for public companies for fiscal years beginning after Dec 2017, and will be testable on the CPA exam beginning in Jan 2018.

What’s In Store For The 2016 Tax Season? Get The Scoop

What’s in store for the 2016 tax season? While we don’t have a crystal ball that sees into the future, we have been following IRS updates, tax industry news, and other sources that can paint a pretty good picture of what tax professionals will face this tax season. Here are some things to expect. The […]

Exploring the wage gap and retirement

Women should probably start sooner and save more for retirement than men, given that the average woman is expected to live five years longer than the average man.