*Initial payment due at checkout includes $40 signup fee and 1st month’s payment.* n*Does not include any hard copy books or other add-ons purchased with your order. All hard copy books and/or other add-ons will be paid at checkout in addition to signup fee and first month’s payment.n Standard Edition (without books): n$198.67 for 3 […]

Displaying: November 2020

What Hiring Managers Are Looking for on an Accountant’s Resume

Whether you’re a brand new graduate looking for your first real-world job in public accounting, or a seasoned accountant eyeing up that next promotion, your next big break is hinged upon your resume and the skills you bring to the table. That’s why it’s crucial that you best prepare yourself to take the accounting profession […]

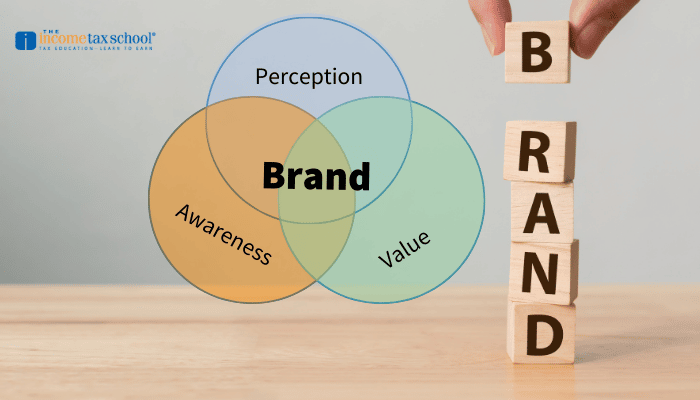

How to Grow Your Brand As A Tax Pro

Becoming a tax preparer and “hanging up a shingle”, as they say, is one thing. Getting people to trust you to prepare your taxes is another. Sure, your client base will start off with friends and family and their extended network, but if you want to be successful, you’ve got to go beyond that. Establishing […]

4 Things You Need to Support Your Clients Virtually

As we prepare for another tax season during a global pandemic, it’s time to think critically about serving clients safely and conveniently. Last tax season dragged out due to COVID-19 causing a delayed filing deadline and extensions. This year, we face a full tax season with COVID-19. Are you fully equipped and ready for what […]

We Teach – Group Discount – AFSP 18 Hr Non-Exempt Package

FOR NON-EXEMPT PREPARERS n Bundle Includes: n n 6 credit hours AFTR Course n 2 credit hours Ethics n 2 credit hours Income, Expenses, and Basis n 2 credit hours Business Organization n 3 credit hours Tax-Related Investments n 3 credit hours Responding to the IRS n nThis Bundle contains all necessary credits for a […]

We Teach – Group Discount – AFSP 15 Hr Exempt Package

FOR EXEMPT PREPARERS n Bundle Includes: n n 2 credit hours Ethics n 2 credit hours Income, Expenses, and Basis n 2 credit hours Business Organization n 3 credit hours Federal Tax Law Updates n 3 credit hours Tax-Related Investments n 3 credit hours Responding to the IRS n nThis Bundle contains all necessary credits […]

Which Accounting Certification Is Best? – A Review of the Top 5 Certifications

Accounting majors have an array of careers available to them, and specializing by getting an accounting certification opens even more doors. But the big question is: which accounting certification should you go for? Below, we’ll go over the five common accounting certifications to help you decide which one you should choose for your career. 1. […]