If you’ve been thinking about taking your education to the next level, there is no time like the present! Earning a certification will lead to great things in your future. Investing in yourself should be a top priority When you have new knowledge and skills, you’ll notice a level of excitement you didn’t have before. […]

Displaying: April 2021

A Home-based Tax Business is More Attainable Than You Imagined!

Thinking of starting a home-based business but afraid you might be biting off more than you can chew? Think again! Getting into the tax business is extremely affordable and absolutely doable whether you choose to start as a side business or go all in. Minimal start-up costs The costs to get started with a home-based […]

TEST – AFTR Course

This 6-credit hour course includes a 100 question comprehension test (3-hr timed test). Students will have up to 4 attempts to pass this test. Test answers and instructional feedback are not provided for the AFTR course. Upon purchase, you will receive login credentials and may start your CE right away. These courses are not webinars, […]

Benefits of Working from Home as a Tax Preparer

Working from home has its benefits. We’ve put together a list of the top reasons we think working from home as a tax preparer is awesome! A Flexible Schedule, Improved Efficiency, and a Boost in Productivity Increased flexibility is a huge plus when you work from home. Outside of meeting with clients, whether it’s face-to-face […]

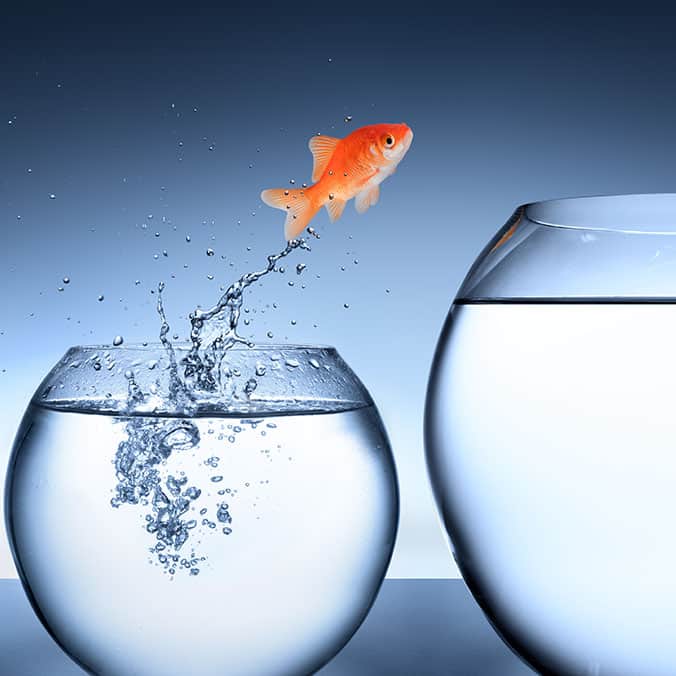

Change is Good

It’s been a little over a year since the world shut down due to COVID-19. We’ve all had to learn to adjust our lives and go with the flow more than ever before. Here are just a few things we’ve learned at Surgent Income Tax School during this unprecedented time… Change is a good reminder […]

FREE TRIAL: Comprehensive Tax Course

This year’s edition has been completely revised and contains pointers you will appreciate as useful, practical advice to be applied in your daily work. Our materials now concentrate on the advancement of careers and profitability. Relevant updates will also be regularly provided so that you remain informed on your craft. Upon completion of this course, […]

7 mistakes CPA Exam candidates make on simulations (and how to avoid them!)

When it comes to CPA (Certified Public Accountant) Exam scoring, the AICPA gives equal weight to Multiple Choice Questions and Task-Based Simulations/Written Communication Tasks. In fact, Sims account for a greater portion of a candidate’s exam section score than ever before, causing simulations (or sims) to become a larger portion of a CPA candidate’s exam […]

Tips for Starting a Tax Business While Working Full-time

It’s hard to take that leap of faith…knowing that if you leave your current job, you may struggle to pay your bills until your business starts bringing in enough income. It can also be hard to find the time and energy to do the responsible things, while also following your passion. Here are some tips […]