The CPA exam contains simulations in all 4 sections. In the AUD, FAR, and REG sections, these simulations are worth 50% of your overall score, and 35% in the BEC section. As these simulations are worth a such a large portion of your exam score, it is crucial to adequately prepare for anything you may […]

Displaying: Professionals

EA vs CPA: Which One is Right for You?

EA vs CPA – From working in management to becoming tax professionals, accounting students have plenty of options when it comes to credentials and specializations. We’ll talk about two of the most popular tax-related credentials/licenses, the Enrolled Agent (EA) and Certified Public Accountant (CPA), explain how they’re different, and help you decide which credential is […]

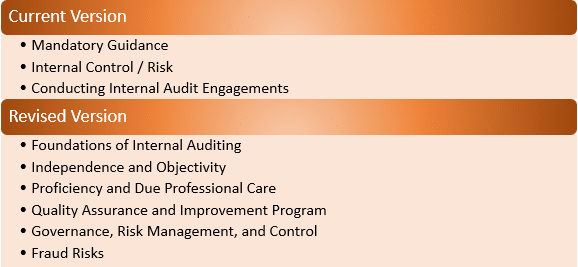

Internal Auditors: Everything You Need to Know About the 2019 CIA Exam Changes

In January 2018, the Institute of Internal Auditors (IIA) announced major changes to the Certified Internal Auditor (CIA) exam. In this post, we’ll cover the why, when, and what of the CIA Exam changes, and how you can properly prepare yourself to pass the new exam. Why is the CIA Exam Changing? Internal audit practices […]

4 Reasons Why Adaptive Learning Technology Is Great for Working Professionals

Becoming a CPA is the dream of many working professionals, but the thought of getting back to studying and preparing for the exam can seem daunting. Luckily, adaptive learning technology is paving the way for working professionals to study more efficiently and pass the exam in a shorter amount of time than traditional study methods. […]

Top 5 reasons to get your CPA credential

As you finish up your college career, you may be considering becoming a CPA. Many new accountants wonder if the benefits really outweigh the challenging process of getting credentialed. The reality is, becoming a CPA is not for everyone and it really depends on your career goals. We’ve put together 5 reasons to get your […]

Student saves time, passes CPA Exam when switching to Surgent

Hi, my name is Jonathan Marseglia, I am a tax manager and tax attorney at Garcia & Ortiz PA, and I passed three sections of the CPA Exam by studying about 96 hours per section with Surgent – nearly half of the time that put into studying when I used a different CPA review course! […]

In-depth look at CPA Exam user experience changes

The AICPA strives to make the CPA Exam user experience as seamless and relevant as possible. Starting April 1, 2018, the CPA Exam will undergo a user experience update to closely mimic the accounting working environment and improve the candidate experience. We’ve compiled a list of the biggest updates you’ll see on the CPA Exam, […]

How the Tax Cuts and Jobs Act impacts CPA Exam candidates

Each year, the CPA Exam is updated to include relevant topics based on new legislation, updates to the Authoritative Literature by the AICPA, or other changes affecting the business environment. As a CPA Exam candidate, knowledge of what these updates are and when they go into effect can be critical; they’re huge indicators of what […]

FASB releases ASU 2018-01 on land easements

The Financial Accounting Standards Board (FASB) has issued Accounting Standards Update (ASU) 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842, that clarifies the application of the new leases guidance to land easements. Lease amendments (ASU 2016-02 and 2018-01) are effective for public entities with annual periods beginning after December 15, […]